Create pay documents and get email copies within minutes.

Convert employer e-payslips to printed payroll stationery. Or calculate documents from gross or net pay amounts with ease. Create unlimited free samples before you buy and get high quality PDF copies in minutes. Printed items are optional and posted first class.

Create Documents →

If you're an employer with casual payroll requirements. An employee who needs copies of lost payslips. Or you receive e-Payslips and need printed forms.

You can create wage-slips in minutes. Transfer data from e-payroll, or let us calculate from a gross or net pay amount.

Continue reading →

There are 3 ways to get a copy of your P60. You can ask your employer.You can get in touch with HMRC who can provide something similar (but not a P60). Or... get a P60 online. In this post we discuss the benefits of each.

In just a few minutes we walk you through how to get your P60 online in 2023. Cover the key things to know before you start.

Discover how to get a copy P60 document in 2023, including from employer, HM Revenue and Customs (HMRC), or a fast online service.

Creating online payslips can be a convenient way to manage payroll information. Our self-service application allows you to create pay documents quickly and easily. Here are some tips and tricks to help you create accurate and complete payslips

With just pay amounts you can use our fast online service to create P60 documents for 5 years (or more). We send you email copies and genuine P60 printed stationery by post.

There are times when a P60 can get lost, misplaced or damaged. We help replace lost documents online in minutes.

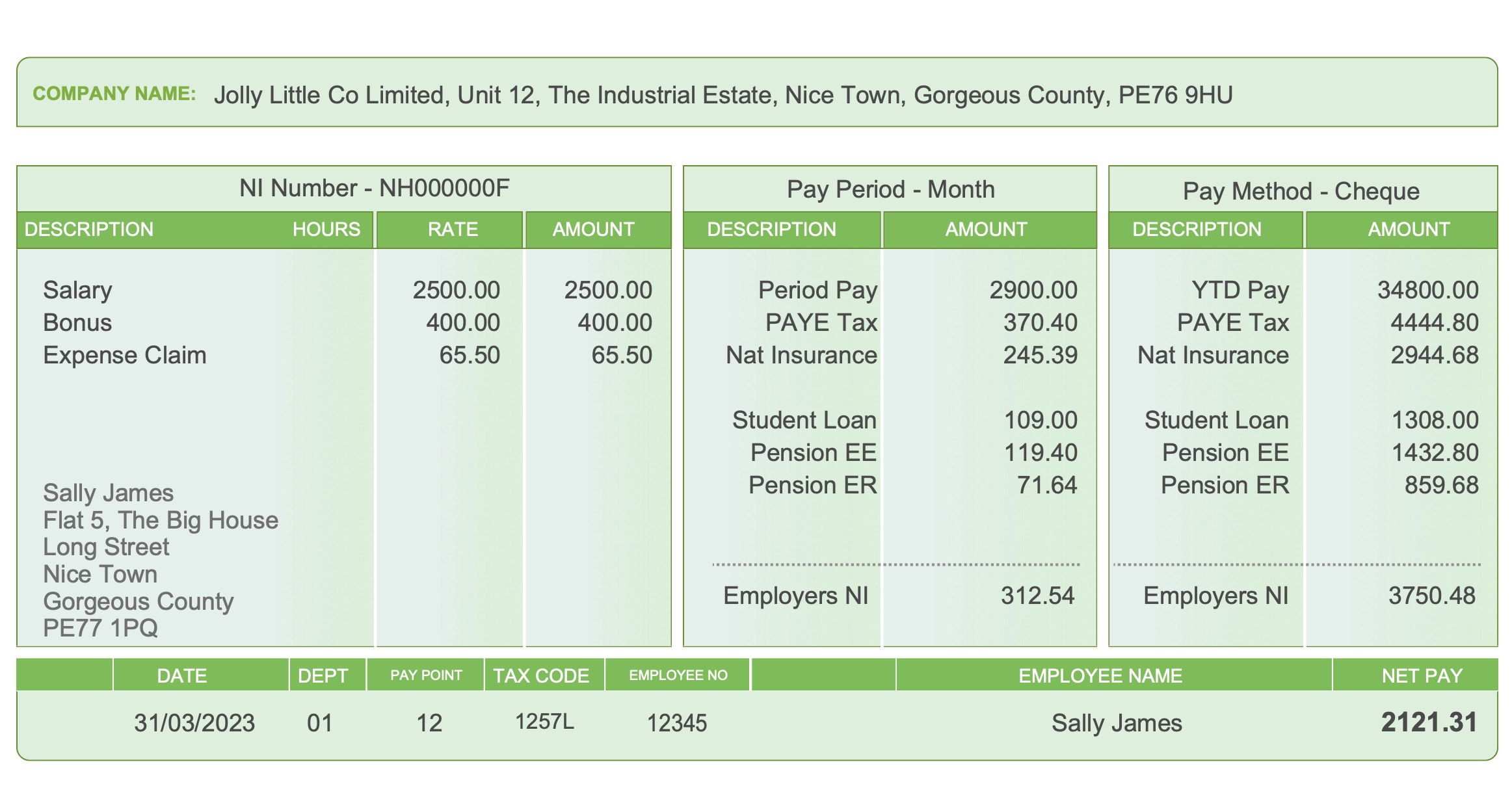

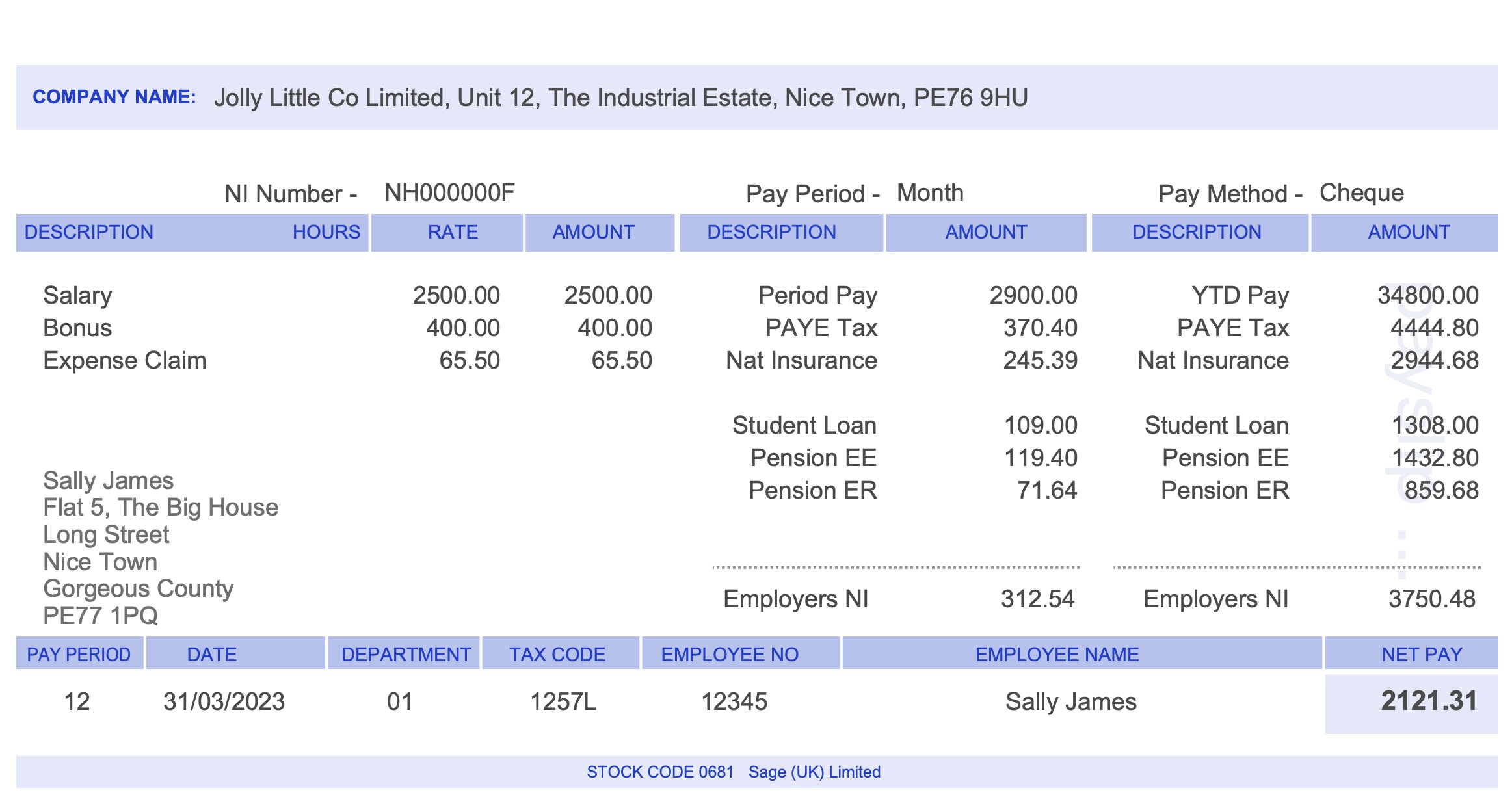

In this breakdown we explain the different options you can select for your payslips.

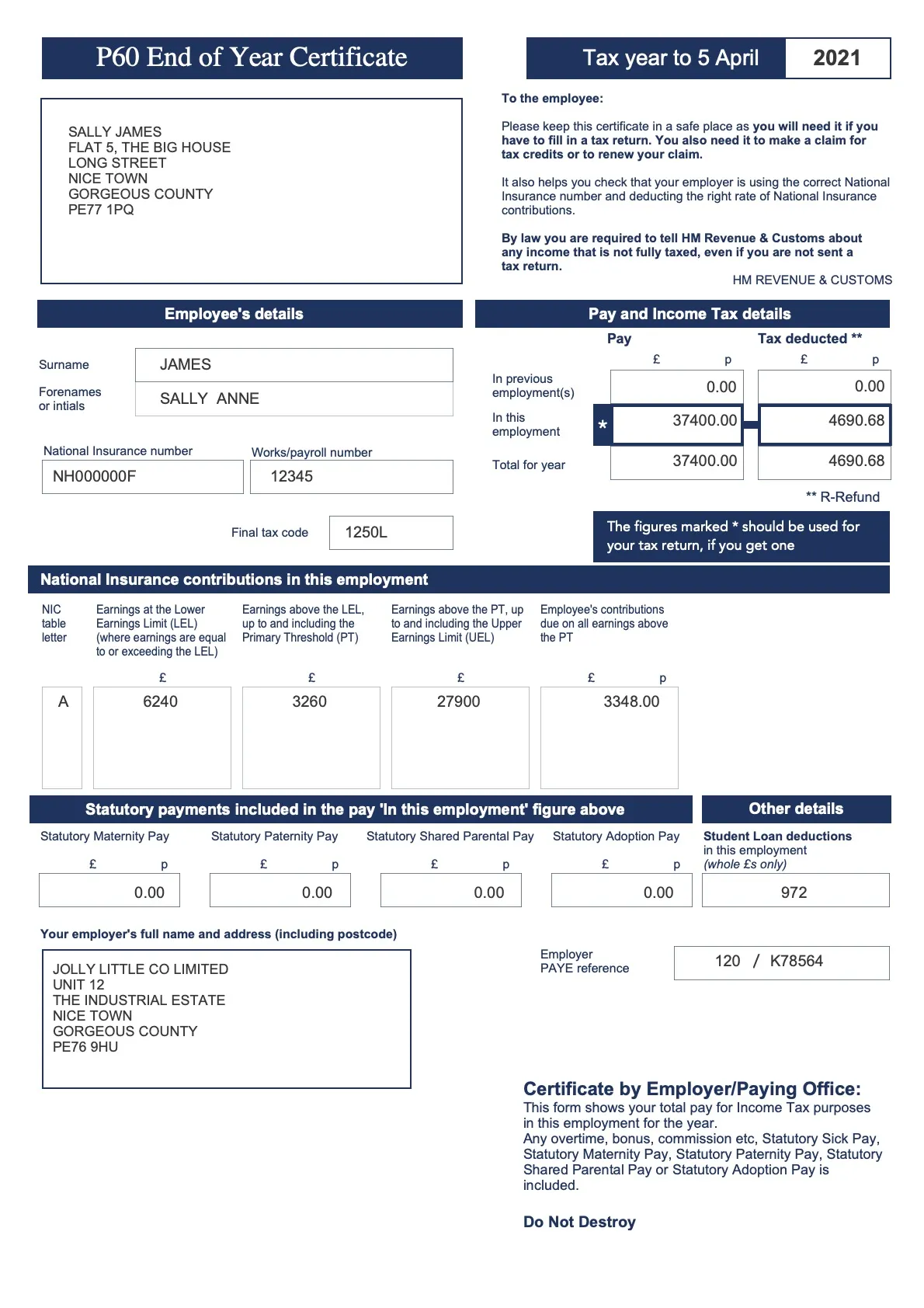

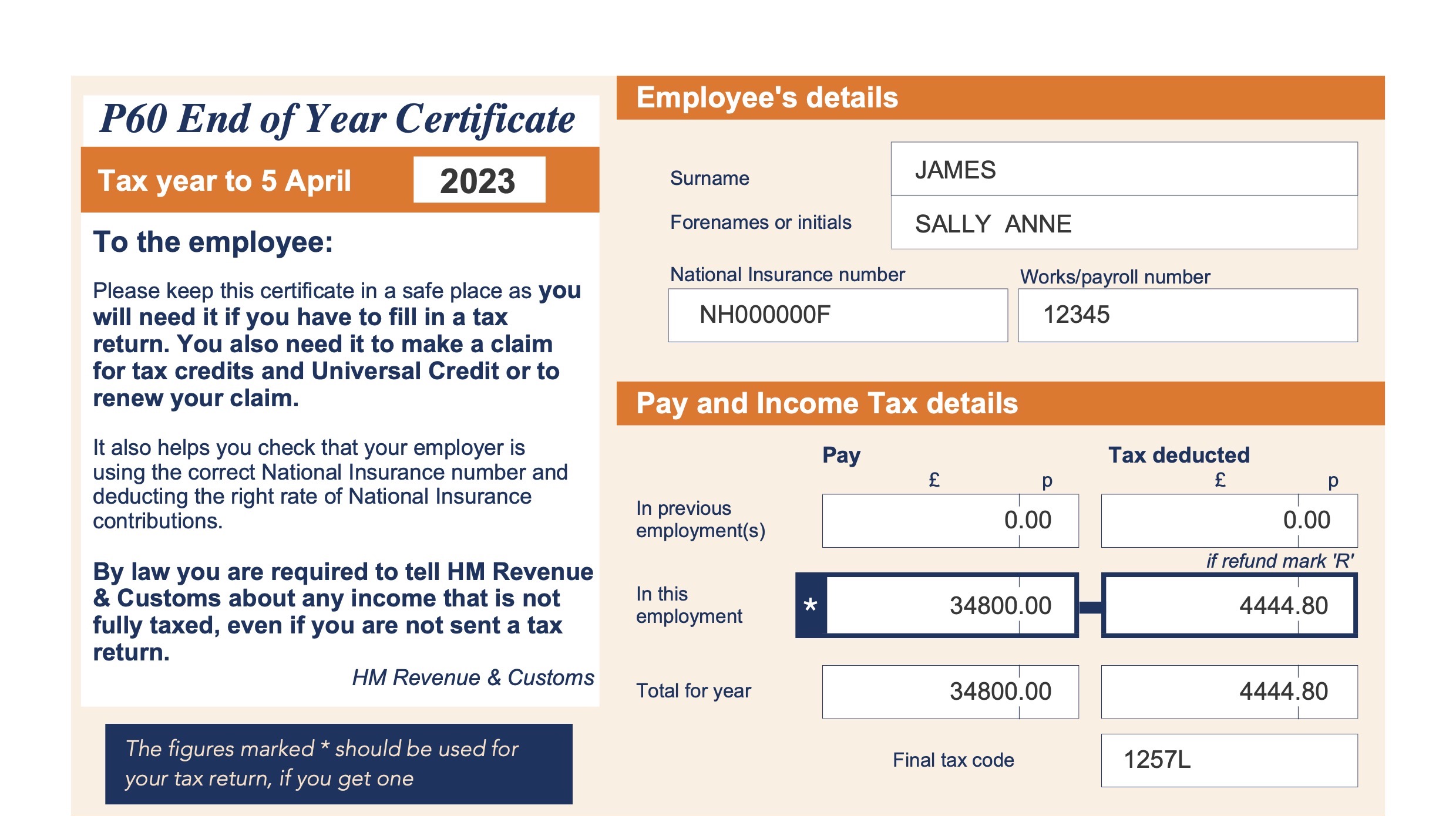

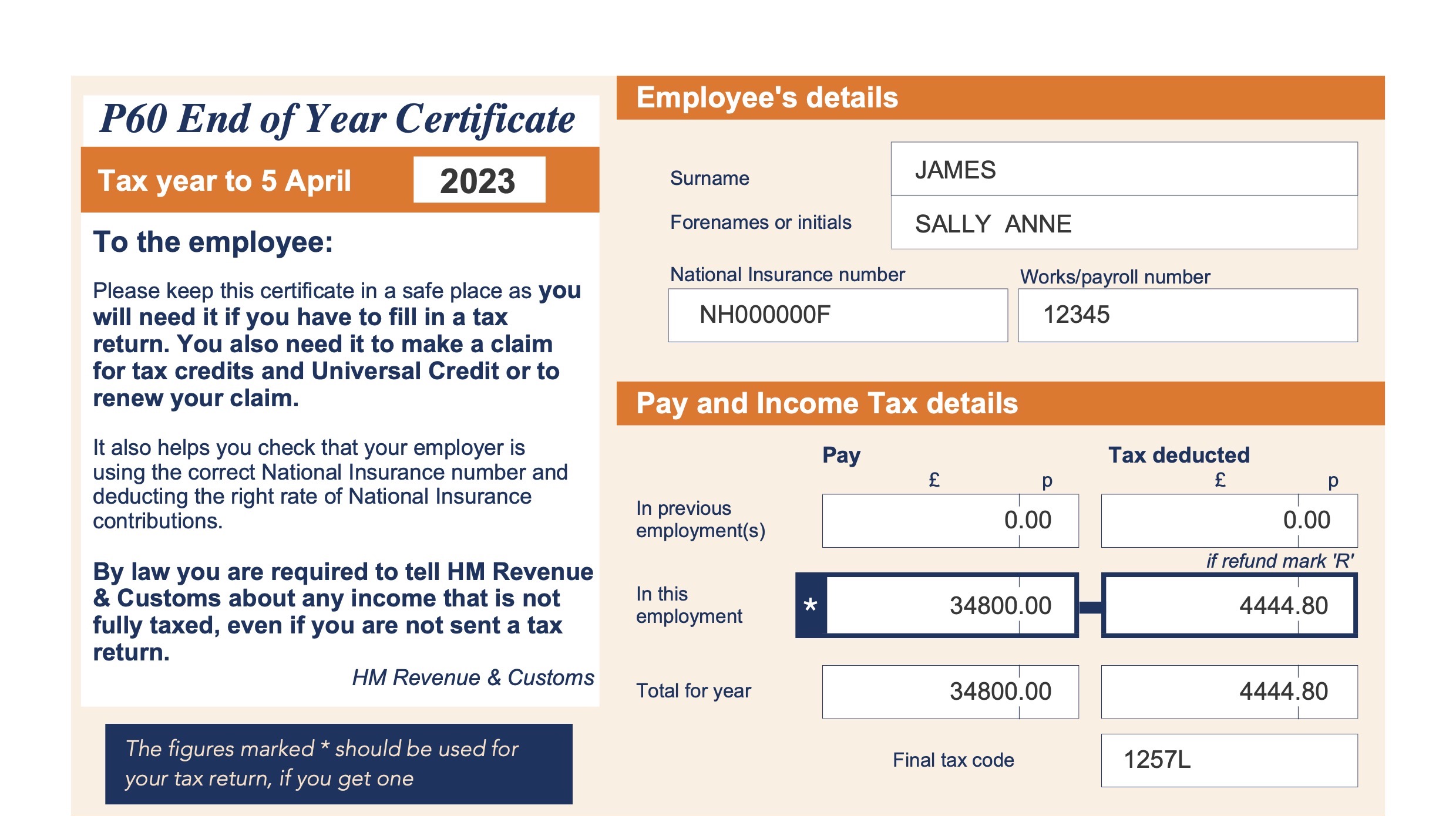

Your P60 certificate is a summary pay document. In this post we breakdown the information used to create your P60.

We don't keep your personal information on our servers longer than necessary. This is for your data security. The only information we keep is an invoice record on our ledger. That means you can not simply add extra dates to an order placed weeks before.

The coronavirus has transformed how payrolls work and exacerbated existing complications. A number of financial support schemes kept organisations afloat during the pandemic. Many UK employees have had to be furloughed, with the government paying most of the wages of people who cannot work or whose employers cannot afford to pay them. In fact, some employees are still on furlough.

The P60 Document for the pay year to 5th April 2023 is issued shortly after payroll year end. Create your sample document now.

Get FREE samples to see if you want them before you buy... We have been creating Replacement Payslips & P60 Documents a very long time. Company payroll even longer. We make it easy to try our service because we're confident you'll be happy.

Let us walk you through the replacement payslip styles and options available so you can decide what's right for you.

OSCP Online Store / OS Payroll

Newgate St, Morpeth, Northumberland

NE61 7ST