Create pay documents and get email copies within minutes.

Convert e-payroll to printed documents, or replace lost items. We send copy payslips by email within 30 minutes. Then decide if you want to buy. Simple, no fuss, professional payroll.

Create items. Pay if happy. Simple!

We make it easy to try us out. We're confident we can exceed your expectations. Take a look at our payslip styles then create your items. You get high quality PDF documents by email to see if they are what you need.

We stock a choice of styles. Except for the employee address they all include the same pay data. PDF copies exactly match the printed stationery if you need both.

All products are the same price regardless of style or colour.

This replacement payslip style can include the home address but it doesn't look odd if not included. Plenty of space for the company details and the layout is very logical. It makes a great universal design. The printed payslip is 210 x 148mm. Single cut on 160gsm heavy white uncoated paper. It comes in 4 colour choices.

Standard style payslips do not include the employee home address. They are all popular with UK companies. They have enough space to show the full company address if required. Paper quality is 80gsm and they come 2 per sheet. Perforated you fold and tear the perforation to separate.

The Plus style is popular with users of Sage payroll systems. It comes in two colour ways. Blue is the most popular with clients but they are otherwise identical. They include the employee address. The company name and address space is only 90 characters. So you can either enter the company name on its own. Or if you input the address it may get shortened to fit. Paper quality is 80gsm and they come 2 per sheet as above.

The Security Mailer is a payslip and envelope in a single construction. After print the company would usually seal them. The employee address would show through a transparent window. The payslip could then go in the post. A special print pattern provides security from prying eyes. You tear along the edges to access the pay data when received. We supply unsealed in a covering envelope for economy when shipping. But you can seal and re-open if required.

To keep it simple we charge the same regardless of style. It also cost less if you need a run of pay dates. After the first three, extra payslips are only £2.00 each (£1 if you only want email).

Some customers don't need printed documents. We apply a discount based on shipping preferences.

We don't advertise cheap payslips then cut corners to make it worthwhile. Our prices allow us to prepare your order with care. You get genuine pay stationery. A fast service. Free samples. Free amendments. And we refund if you don't need them.

We're confident our payslip service will be exactly what you need. That's why we make it easy to try us out with free samples. But don't overlook the other benefits. If you find later you forgot to include something, you can edit free of charge. Even if we already shipped your order.

Our refund policy is simple. If they don't meet your needs we refund super quick. No fuss. No song and dance.

We've been doing this a long time. A big part of our business comes from recommendation by clients. So we're doing something right!

Click the free sample button. We'll email your PDF copies. If happy there's a link included to pay and we process your order. Printed items (optional) ship on the next available post.

e-Payslips (electronic, email) are quite common now. It's easier and less costly for the employer. Some employers will provide printed salary information (if asked). We often produce copy payslips for companies with occasional requests.

If you need a print copy or lost your wage slip you can get a replacement. Our free sample service lets you play around with styles and designs. Choose layouts and the information to include.

They can be very simple, matching either a gross or net salary. Showing the standard deductions. Perfect if you lost payslips and can only find dates and amounts from a bank statement. We don't have access to check how much you get paid. We calculate based on either the gross or net amount you specify.

You can also build more detailed summaries if needed. Options include salary, hours & pay rate, bonus, commission, allowances, expenses, SMP / SSP. We can add furlough pay or notes about holiday on request.

Dates can be last week, last month, last year or 10 years ago. Using the correct pay tables we can generate payslips for that period.

We calculate standard deductions for tax and national insurance. Other options can show healthcare, student loan, workplace or private pension.

We can show your employer NI contribution if this is usually included. Some items are standard and we will work those out.

Healthcare and private pension will depend on your personal scheme. You have the option to override our system calculations on any or all item(s).

We make it very easy to order or create samples. Follow along and answer some simple questions using our secure form.

Within minutes one of our payroll team will review for any obvious errors and forward PDF copies. You can then use our quick link to amend without all the data entry. If happy a simple click to buy.

You can print the PDF (300dpi resolution) but much depends on your printer and settings. If you need us to print them we use genuine payroll stationery in matching designs.

We send both electronic version by email and printed by post. They usually arrive next working day if ordered by 3pm (Mon-Fri).

How does it work? - It’s very simple. Submit documents based on your pay information. Our software calculates tax & national insurance contributions (or you can provide amounts). One of our team will check you entered everything correctly and process your order.

Who is it for? - Staff who receive e-Payslips and need a print copy on genuine stationery. Employees who have lost payslips to replace. Small business with casual worker requirements.

What do I get? - You receive 300dpi PDF copies by email and the option of printed copies by post.

How long does it take? - We're quick. During office hours, within 30 minutes or less. Postal items ordered before 3pm ship same day First Class. Usually they arrive next day but that is not guaranteed.

Can I print them? - Yes. The PDF is a 300dpi image. Much depends on your print settings. Make sure you are set to print at 100% at actual size (not fit to page). The genuine pay documents we supply will always be better.

I'm not sure of my details? - You know the important things. Your name, company, NI number and pay amount from your bank statement. With that you can reverse calculate your payslips with a high degree of accuracy.

Do I place an order for each one? - No. Order the quantity you need. You add different dates and amounts. They don't have to be all the same. Currently 13 is the most you can submit on a single order. If you need more place a second order.

Are you able to calculate old payslips? - Yes. Our software uses pay tables from 2005 to the current pay year. We can calculate documents for any dates within that period.

Do I place an order for each one? - No. Order the quantity you need. You add different dates and amounts. They don't have to be all the same. Currently 13 is the most you can submit on a single order. If you need more place a second order.

Are you able to calculate old payslips? - Yes. Our software uses pay tables from 2005 to the current pay year. We can calculate documents for any dates within that period.

Do you include student loan? - Yes. We can calculate Plan 1 or 2. You can also provide your own figures. We do the same for workplace pension and employer NI contributions.

Can I provide full calculations? - Yes. Enter full details from your payslip or let our software create the figures.

What if I make a mistake? - No problem, you can amended without charge. Resubmit and use voucher code ADMIN to skip payment.

What if I make a mistake? - No problem, you can amended without charge. Resubmit and use voucher code ADMIN to skip payment.

Will my payslip look exactly like my original? - Not exactly the same. Check the templates shown on our website for the best match.

I'm not sure of my tax code? - Unless you have a special code we will calculate using the standard tax code for the pay year. If you paid too much or too little tax or it's a second job, you may have a special code.

Can you check with employer for me? - No. We can't verify with employer or HMRC. We will workout correct payroll deductions based on data provided.

Can I use as proof of income? - Last 3 month payslips are usually requested along with bank statement. Ensure that your net pay amounts match the deposits in your bank account. But yes they will.

If I forward my payslips can you copy? - No. Enter the data on our order form. They will look like the template style you choose. You have full control over the amounts & calculations if you need to make changes.

How can I pay? - We accept credit or debit card using Paypal as a processor (you don't need a Paypal account).

Can I order over the phone? - We only accept online orders to avoid errors and speed up the process.

Can you post international? - Yes we can send to any location although we can't guarantee when it will arrive. We post to Spain, France, Australia and USA which takes about 5 days to arrive.

What about earnings outside the UK? - No. Only earnings subject to UK tax laws.

What if I need something not shown on your site? - Sorry we're set up to cover the most popular options and don't offer a custom design service.

Will I get real pay documents? - Yes. We use popular stationery from the major software providers, and approved P60 forms. You will also receive an email copy generated from our software system.

How does the money-back guarantee work? - We expect you to be happy. We've been doing this a long time and are confident we've got it right. If any item does not meet your needs (for any reason) we refund your order without any fuss. A simple email 'Hey guys, can I get a refund' is all we need. We always value feedback but it's not required. We process payment within hours. There's no need to return the goods.

Will you price match? - No. We ask a fair price and don't cut corners to offer cheap payslips. You get email copies in 30 minutes. There are no hidden extra fees. You can get a free sample before you buy. They'll be excellent quality. We refund if you don't want them (for any reason). Documents will arrive on time. We offer great value and no risk.

But you refund if I don't want them? - Yes. We expect you to be happy. If our product fails to meet your needs we refund the sale. No explanation required, email us and we'll return your payment. If in doubt try a free sample first.

What information do I need? - Simple payslips need only take home pay. Detailed payslips with hours worked, rate of pay, bonus, commission need extra data. Other information needed are company and employee details and national insurance number. See below how to create payslips.

If you have e-Payslips and need them converted to print copies or need to replace lost items, it's quick & easy. Create sample documents and we email you high quality PDF copies. Pay if you want them. Simple. No fuss. Payroll.

Start by selecting what you need. Payslips, P60, or both. In this example we'll select payslips and show how to create a P60 in another post.

Use the (Change Style) button to cycle through payslip designs until you find what you need.

Enter the company detail.

You must enter the company name but the address is optional.

Some layouts have a smaller amount of space so an address may display shorter.

Add the employee (worker) name.

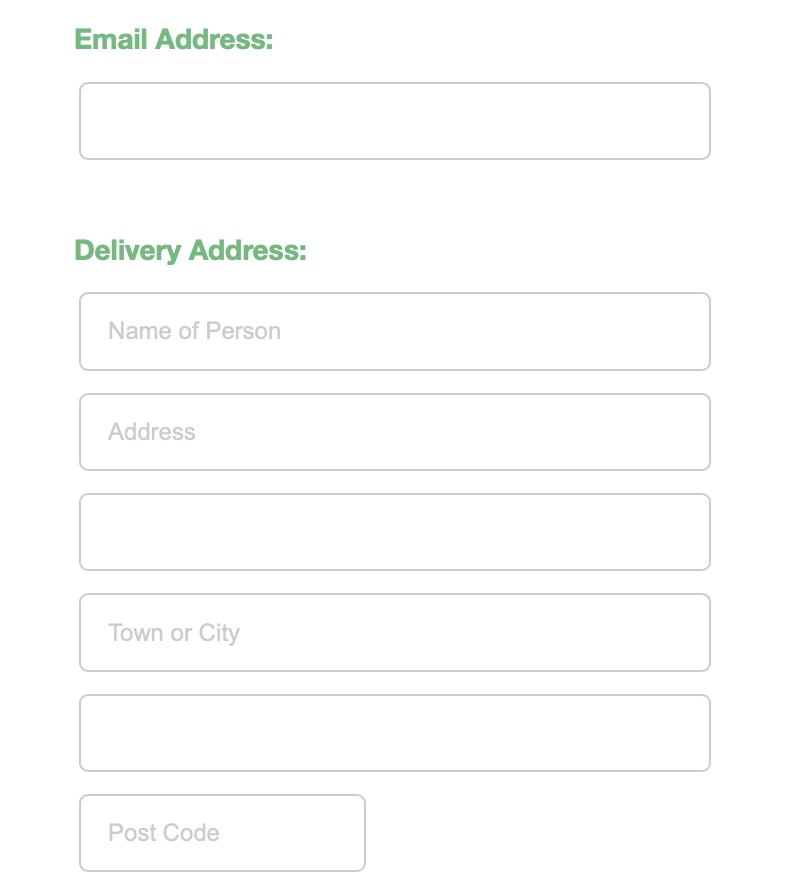

If you selected a payslip style that includes the home address enter that too.

If you don't see address fields choose another payslip style.

Enter employee national insurance number.

Check box if 67 years or older. This adjusts the NI calculation.

Work ID is optional but payslips can look odd with an empty space.

Enter the correct tax code next. If unsure leave empty and we use standard for pay date.

If you live in Scotland change tax region. The calculation is a little different to the rest of the UK.

Choose pay method. Bank is most popular but you have other options. Bacs. Cash. Cheque, etc.

Select the pay period. You can choose from Month, Four Week, Two Week, or Weekly pay.

Don't mix up Monthly and Four Week. They are not the same and will calculate different. Four week pay is every 28 days exact. Pay day would be the same day of the week. If paid on a Friday it would always be Friday.

Monthly pay can vary. Pay day could be any set date ( example 24th ). It could be last work day of the month. Last calendar day of the month. First of the month. Last Friday of the month, etc.

This is important because there are 12 monthly periods in the pay year and 13 four week periods. Allowances and calculations use this figure. If incorrect it will show incorrect pay amounts.

Choose standard or advanced options.

For now we will leave as standard but will show advanced in the last section.

Enter the payslip date. If you need more than one enter the first date.

Example - If you wanted Jan, Feb & March enter January date first. Then enter the pay amount.

Is that before deductions ( Gross Pay ) or take home amount ( Net Pay )?

Using the ( + Add Date ) button you can then enter the next date and amount.

Add any of the standard options to include.

We will apply standard calculations but you can provide custom amounts using advanced control.

In our example we said we wanted Jan, Feb & March payslips.

You can enter the total year to date figures from the previous payslip (in this case Dec) and it will carry forward.

If pay is always the same amount it is not required.

If empty we use the pay from your first payslip and pro-rata that to the start of the pay year (April 6th).

If work started after April 6th enter the first pay date and year to date will show only months worked.

Choose shipping method.

If you only want email a 50% discount will apply.

If you want samples first check the box and you skip payment.

Enter email and any shipping details. Submit the request.

If you selected sample your order will be in our system and we'll email copies very soon.

Otherwise make payment and we process your order.

With standard options we do all the calculations. Advanced lets you provide all (or some) of the data and overrides the system generated figures. Use to create print copies of e-Payslips.

If paid an hourly wage you can enter hours worked and pay rate.

Enter a bonus or commission.

If you claim expenses add them too.

Custom pension figures.

Your own student loan and healthcare deductions.

Custom calculations for tax, national insurance, and employer NI.

Also set a target net amount to match

You can create as many samples as you wish so feel free to jump in and play around until happy. Use the green button above to get started.

Can I create payslips online free? - You can sometimes find spreadsheets you can download free of charge. But you need to ensure they are for the correct pay year. Our service lets you create free samples but we charge a small fee if you want actual wage slips.

Can I get fake payslips? - You can make payslips show any amount. We can't verify with the employer or HMRC. We calculate correctly and print on genuine stationery.

But… fake payslips are useless. They need to match bank data and credit profiles. Your payslip could say you earn a small fortune but if your digital footprint doesn't match it's easy to see.

How to get copies of old payslips. - You can create copy pay documents going back to 2005. You need to know your salary and if you paid standard tax or had a special code. Our software uses old pay tables to work out tax & national insurance deductions. You will need to know your salary at the time.

OSCP Online Store / OS Payroll

Newgate St, Morpeth, Northumberland

NE61 7ST